By guest author: Keith Latiolais, MBA, MHA

On July 12, 2018, the Centers for Medicare & Medicaid Services (CMS) released their annual changes to the Medicare Physician Fee Schedule (PFS) and other Medicare Part B payment policies. Proposed rule CMS–1693–P includes proposals to update payment policies, payment rates, and quality provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2019. The rule was published on July 27, 2018 and is available for public comments through September 10, 2018.

CMS proposed increasing Physician Fee Schedule (PFS) payment rates by 0.25 percent in 2019, as required by the Medicare Access and CHIP Reauthorization Act. After applying the budget-neutrality adjustment which is required by law, CMS estimates the 2019 physician fee schedule conversion factor to increase from $35.99 this year to $36.05 in 2019. CMS included a number of other provisions in the rule including revaluation of outdated E/M code set to address complexity of documentation requirements, distinguish differences among code levels and sites of service, update for changes in technology, especially electronic health record (EHR) use, and physician pay for virtual and telephone visits. Details are available on the CMS website: https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-Federal-Regulation-Notices-Items/CMS-1693-P.html see section I. Evaluation & Management (E/M) Visits.

CMS is proposing implementation of these rules beginning January 1, 2019, but is sensitive to stakeholder comments and as such may consider a delayed implementation which also might allow the AMA time to develop changes to the CPT coding definitions and guidance prior to implementation. To be assured consideration, comments must be received no later than 5 p.m. on September 10, 2018. In commenting, please refer to file code CMS-1693-P. Electronically, commenters may submit to http:www.regulations.gov or by regular mail to Centers for Medicare & Medicaid Services, Department of Health and Human Services, Attention: CMS-1693-P, P.O. Box 8016, Baltimore, MD 21244-8016.

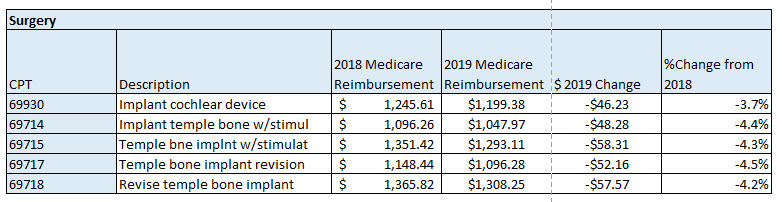

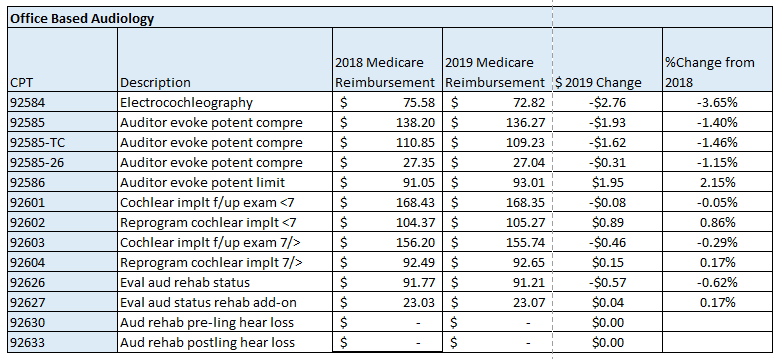

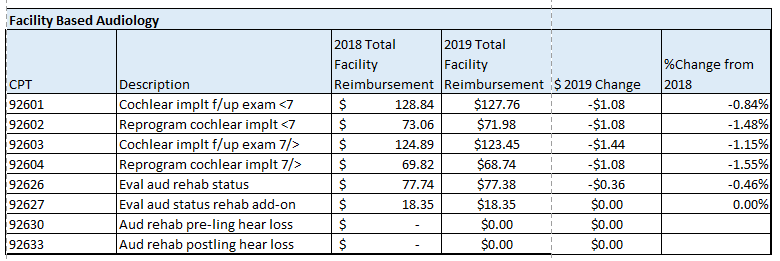

The following is a summary of the impact of the proposed changes specific to professional services related to cochlear implants and auditory osseointegrated implants. The tables below illustrate the difference between the geographically unadjusted participating surgeon and audiologist rates for the current year and those which have been proposed for CY 2019. The last table includes the Medicare allowable rates for facility based audiologist.

Note: Physician payment for services performed in the facility setting (as well as in the office) is calculated using national uniform relative value units (RVUs) that account for relative resources used in furnishing a service. The statute requires that RVUs be established for three categories of resources: Work, Practice Expense (PE), and Malpractice (MP). Beginning in CY2010 with final implementation in CY2013 CMS began using the AMA Physician Practice Expense Information Survey (PPIS) to establish a methodology for Practice Expense RVU calculations. Analysis of 2019 CI implantation codes indicates a reduction in overall RVU, hence reimbursement, primarily due to a re-evaluation of Practice Expense RVU methodology.

Payments are based on the relative resources typically used to furnish the service. Relative Value Units (RVUs) are applied to each service for physician work, practice expense, and malpractice. These RVUs become payment rates through the application of a conversion factor. Payment rates are calculated to include an overall payment update specified by statute.

Payments are based on the relative resources typically used to furnish the service. Relative Value Units (RVUs) are applied to each service for physician work, practice expense, and malpractice. These RVUs become payment rates through the application of a conversion factor. Payment rates are calculated to include an overall payment update specified by statute.

About our guest author:

Keith Latiolais is one of three geographically-based hearing implant reimbursement experts available to assist you with coding, payment, payer coverage, contracting, and other reimbursement-related challenges. Keith’s contact information, along with that of his colleagues and a more detailed description of the reimbursement support offered by Cochlear’s Regional Reimbursement team, can be found on the Reimbursement Support page of Cochlear’s US Professional Resources Website. Please do not hesitate to reach out to the Reimbursement Manager associated with your geography for reimbursement assistance or for questions related to this article. Cochlear offers coding assistance through the Coding Support Line accessible by calling 1-800-587-6910 between the hours of 8 AM – 3 PM Mountain time zone or via email at codingsupport@cochlear.com. For pre-surgical insurance support, OMS is available to assist with pre-authorizations and appeals and can be reached at 1-800-633-4667 option 4.

References:

-

Proposed Policy, Payment, and Quality Provisions Changes to the Medicare Physician Fee Schedule for Calendar Year 2019, Retrieved from: https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2018-Fact-sheets-items/2018-07-12-2.html August 2, 2019